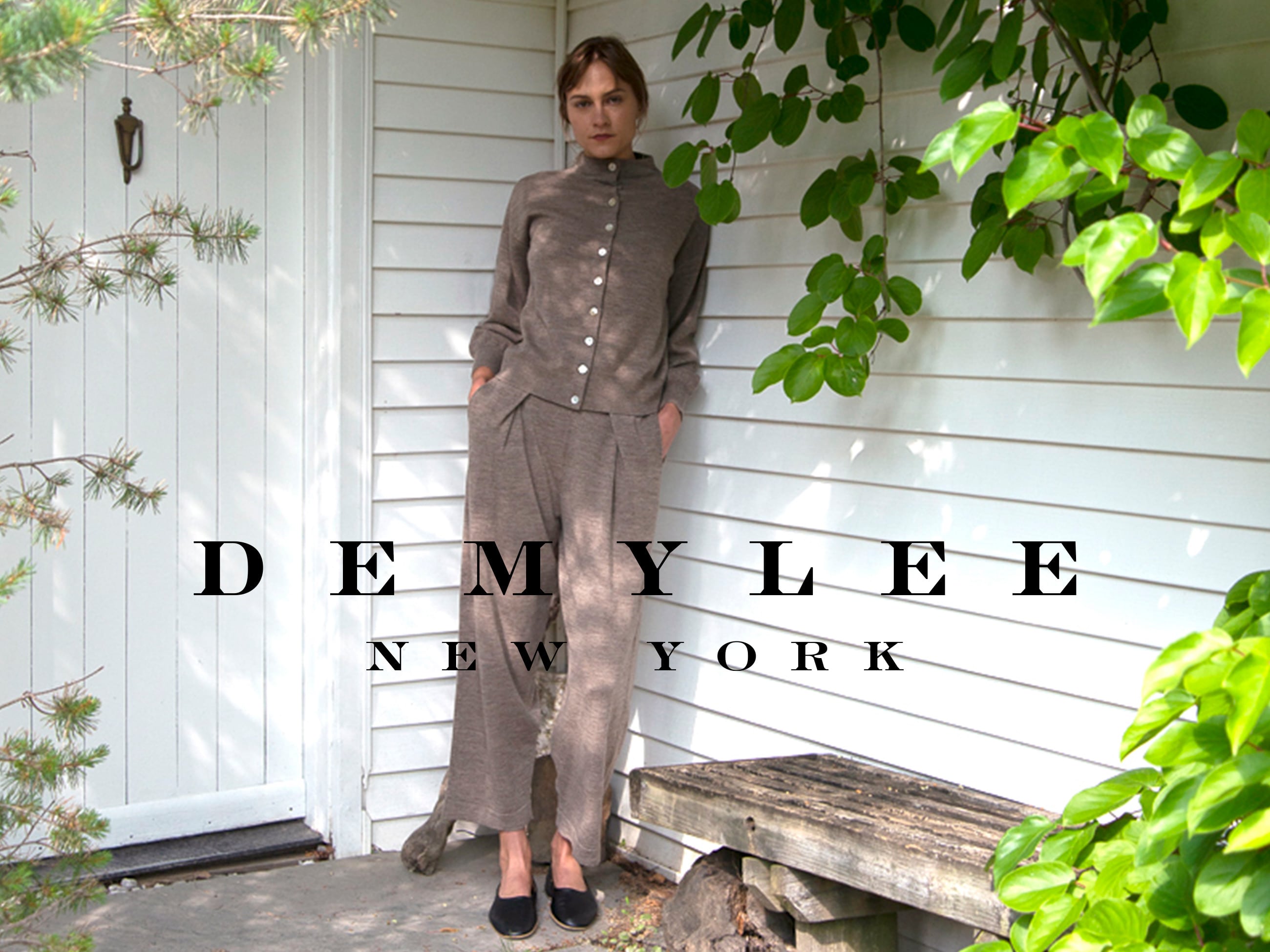

DEMY BY DEMYLEE セットアップ

(税込) 送料込み

商品の説明

DEMY BY DEMYLEE セットアップです。

ロンハーマンにて購入しました。

綿100%です。

3回しか着ておりませんので綺麗です。

最終価格です。

×値下げ交渉

新品ではないので気にされる方はご遠慮ください。商品の情報

| カテゴリー | レディース > その他 > その他 |

|---|---|

| ブランド | ロンハーマン |

| 商品の状態 | 目立った傷や汚れなし |

商品はお値下げ DEMY BY DEMYLEE ニットセットアップ | www.ouni.org

DEMY BY DEMYLEE ニットセットアップ ロンハーマン購入 ピンク

DEMY BY DEMYLEE ニットセットアップ ロンハーマン購入 ピンク-

DEMYLEEデザイナーに聞く!「子育てと仕事」両立の乗り越え方|VERY

DEMY BY DEMYLEE ニットセットアップ ロンハーマン購入 ピンク

商品はお値下げ DEMY BY DEMYLEE ニットセットアップ | www.ouni.org

DEMY BY DEMYLEE ニットセットアップ ロンハーマン購入 ピンク-

DEMY BY DEMYLEE(デミー バイ デミリー)コットン カーディガン-

DEMY BY DEMYLEE ニットセットアップ ロンハーマン購入 ピンク-

商品はお値下げ DEMY BY DEMYLEE ニットセットアップ | www.ouni.org

DEMY BY DEMYLEE ニットセットアップ ロンハーマン購入 ピンク

DEMY BY DEMYLEE セットアップ - その他

DEMY BY DEMYLEE ニットセットアップ ロンハーマン購入 ピンク-

DEMY BY DEMYLEE(デミー バイ デミリー)コットン カーディガン

格安通販サイト DEMY BY DEMYLEE セットアップ - その他

DEMYLEE pop up store News|Ron Herman

DEMY BY DEMYLEE コットンカーディガン - カーディガン/ボレロ

DEMYLEE デミリー コットン カットソー パンツ セットアップ

格安通販サイト DEMY BY DEMYLEE セットアップ - その他

商品はお値下げ DEMY BY DEMYLEE ニットセットアップ | www.ouni.org

DEMY BY DEMYLEE 【在庫あり/即出荷可】 51.0%OFF www.coopetarrazu.com

DEMYLEE New York

DEMY BY DEMYLEE ニットセットアップ ロンハーマン購入 ピンク

DEMY by DEMYLEE デミリー ロンハーマン コットンカーディガン-

チャンピオン DEMY BY DEMYLEE コットンニット ブラック

DEMY BY DEMYLEE Callan Cardigan-

Ron Herman - RHC DEMY BY DEMYLEE Galia Knit Pulloverの通販 by

デミーリー/DEMYLEE】の【DEMY BY DEMYLEE】BALTA メリノウール 幾何学

DEMY by DEMYLEE デミリー ロンハーマン コットンカーディガン-

Ron Herman - RomHerman RHC DEMY BY DEMYLEE パンツのみの通販 by

DEMY BY DEMYLEE(デミー バイ デミリー)コットン カーディガン-

DEMYLEE カシミヤニットのセットアップ – COLDBECK ONLINE

DEMY BY DEMYLEE ニットセットアップ ロンハーマン購入 ピンク-

DEMYLEE マスタード ニットセットアップサイズ - その他

51.0%OFF DEMY BY DEMYLEE 高級素材使用ブランド www.brpb.pl

DEMY BY DEMYLEE ニットセットアップ ロンハーマン購入 ピンク

ELLE SHOP MAIL 2023.8.16

DEMY BY DEMYLEE | View All

ショッピング早割 Demy by demylee コットンニット ベビーピンク

DEMY BY DEMYLEE | View All

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています